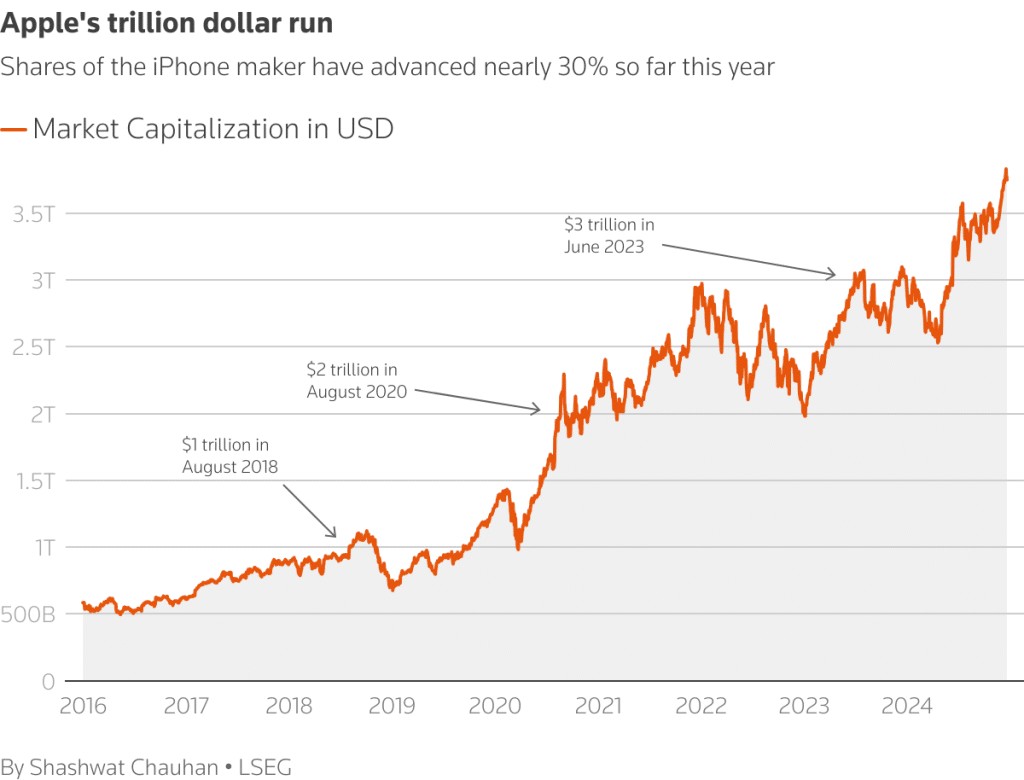

Apple Inc. stands at the cusp of becoming the first company ever to achieve a $4 trillion market capitalization, with its valuation reaching $3.92 trillion in late December 2023.

The tech giant's remarkable 40% stock surge this year has been primarily driven by growing investor confidence in the company's artificial intelligence (AI) initiatives, particularly their integration into iPhones and other Apple devices.

Industry analysts express optimism about Apple's growth trajectory. Wedbush's Daniel Ives recently increased his price target for Apple stock to $325, citing an upcoming "golden era of growth" centered around AI-driven iPhone upgrades. The analyst points to Apple Intelligence, a developing AI strategy that could establish a new multi-billion dollar revenue stream through hundreds of apps currently in development.

JPMorgan analyst Samik Chatterjee reinforces this positive outlook, highlighting potential growth catalysts including Apple's services transformation, expanding user base, and technological leadership position.

As Apple approaches this unprecedented market cap milestone, it leads other tech giants including Microsoft ($3.26 trillion) and Nvidia ($3.43 trillion). The anticipated iPhone 16 cycle and subsequent iPhone 17 release are expected to play key roles in driving further growth over the next 12-18 months.

The company's push into AI technologies, combined with its strong device ecosystem and services expansion, positions Apple to potentially break the $4 trillion barrier, marking a historic achievement in corporate valuation history.